real estate tax shelter act 1986

47 1042 made major changes in how income was taxed. In the case of real estate TRA86 extended the asset lives of commercial real estate to 315 years and residential real estate to 275 years.

Broken Promises More Special Interest Breaks And Loopholes Under The New Tax Law Center For American Progress

Tax Shefters Defined Tax shelters are generally defined as investments in.

. Tax Reform Act of 1986 The Tax Reform Act of 1986 lowered the top tax rate for ordinary income from 50 to 28 and raised its tax rate from 11 to 15 on income over 50701In the US it was the first time that it happenedAnalyzing the income tax history for many years shows that the top tax rate had. The Tax Reform Act was passed by Congress on September 27 1986 and signed by the President on October 22 1986. 2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate many tax shelters.

Helping business owners for over 15 years. Destroying real estate through the tax code. The Act also required straight-line depreciation removing the ability of companies to write off a larger share of the cost in earlier years of the assets life.

During this phase out the effective tax rate is 265 percent. The Tax Reform Act of 1986 had a profound impact upon the real estate industry and as a result the Savings and Loan Industry. Real Estate and The Tax Reform Act of 1986 Patric 1-i.

Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate industry. Taxes on certain types of shelter were also eliminated as a result of the Tax Reform Act of 1986. Although the 1986 act reenacted the great bulk of the 1954 code the.

This means that investors who purchased shares in limited partnerships or similar investments can no longer use these paper losses from depreciation as a shelter against other income. Tax Reform Act of 1986 by Cordato Roy E. Issue Date December 1986.

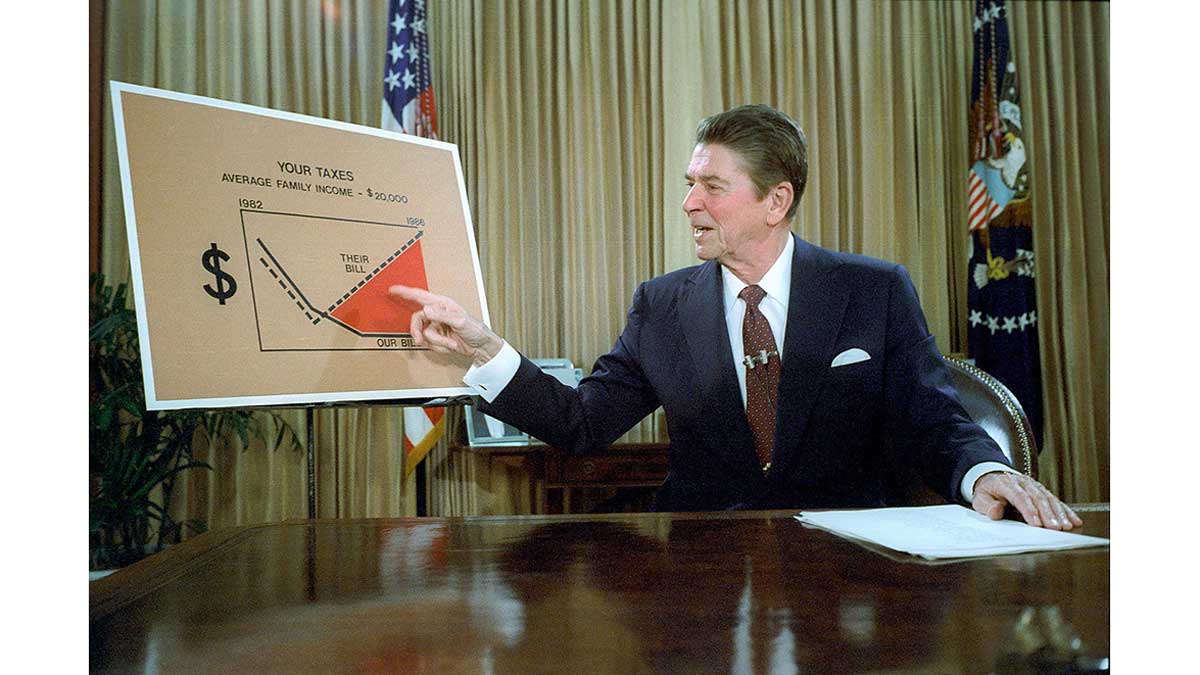

The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. This bill which is the Outcome of a process that began several years ago and included.

Though the act was the most massive overhaul of the tax. A further limitation imposed by the 1986 Tax Reform Act is that investors who dont actively manage their properties cant use their passive losses to shelter any active income. Tax Reform Act of 1986.

However it also increased personal exemptions and standard deduction amounts based on inflation. Exemption is reduced 25 cents for each dollar by which the income base exceeds. The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to.

The act ended the tax codes ability for borrowers to deduct interest on their consumer debt. October 1986 President Reagan signs the Tax Reform Act of 1986. The changes that have contributed to the decline of the industry include the elimination of the capital gains tax differential the increase in the period for writing off taxes for depreciable real.

Congress passed the Tax ReformAct of 1986 the Act on September 27 and President Reagan signed it into lawon October 22. The 1986 Act expands the list of tax. In case you havent been paying attention during 1987 the 1986 Tax Reform Act took away most of the tax incentives for buying investment real estate.

Signed into law by Republican President Ronald Reagan on October 22 1986 the Tax Reform Act of 1986 TRA was sponsored in Congress by two leading Democrats Representative Richard Gephardt of Missouri and Senator Bill Bradley of New Jersey and was strongly supported by the chairman of the House Ways and Means committee Democratic Representative Dan. T he Tax Reform Act of 1986 PL. Most of the provisions of the act were effective January 1 1987.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. INTRODUCTION The Tax Reform Act of 19861 the TRA86 curtailed significant tax benefits previously available to real estate investors2 One ofthe most important changes of the TRA86 was the extension of the at-risk rules. As a result the tax code is now formally known as the Internal Revenue Code of 1986.

The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term. Among its real estate provisions there are several new rules that prevent taxpayers from using partnerships to shelter earnings from other sources. 2085 implemented a tax code that at once swept away and reenacted its predecessor the Internal Revenue Code of 1954.

Congress passed the Tax Reform Act of 1986 TRA PubL. The Tax Reform Act of 1986 is a law passed by Congress that reduced the maximum rate on ordinary income and raised the tax rate. The act either altered or eliminated many deductions changed the tax rates and eliminated several special calculations that had been permitted on the basis of marriage or fluctuating income.

The Tax Reform Act of 1986 100 Stat. 1986 Tax Reform Act Was a major legislative change toward reducing tax shelter benefits and thereby restoring greater equity to the Federal tax code. It has often been suggested that the collapse of the industry during the late 1980s and early 1990s was a result of.

Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored. Referred to as the second of the two Reagan tax cuts the Economic Recovery Tax Act of 1981 being the first the bill was also officially sponsored by Democrats. A few were retroactive to January 1 1986 and some are phased in over the next few years.

Within the broad aggregate however widely different impacts are to be expected. THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S.

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Depreciation Man How Adam Neumann S Property Cuts His Taxes

The Low Income Housing Tax Credit Program Costs More Shelters Less Npr

Capital Gains Full Report Tax Policy Center

The Capital Gains Tax And Inflation Econofact

Wandering Tax Pro Remembers The Tax Reform Act Of 1986

Depreciation And The Taxation Of Real Estate Everycrsreport Com

Reagans 1986 Tax Reform Act Lowered Taxes Simplified Reporting

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

Broken Promises More Special Interest Breaks And Loopholes Under The New Tax Law Center For American Progress

How Is A Tax Shelter Calculated In Real Estate

Capital Letter No 51 The American College Of Trust And Estate Counsel

Podcasts Tax Smart Real Estate Investors Podcast

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy