are dental implants tax deductible in the united states

Citizen or resident alien for the entire tax. Dental implants are considered a medical expenses.

3 Irs Dental Implant Discount Plans Tax Deductible Savings

To get help with your dental implant cost you can use the Tax deduction as well.

. Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners. Claiming dental expenses is an allowable deduction on your tax return. When use tax is a factor Use tax in the United States is complementary to sales tax which means if you buy taxable products without paying sales tax to the vendor you owe use tax.

1 Follow along as we break down the hidden features benefits and caveats for each of the three options and illustrate the potential savings. When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021. More than 80 of them are women and children and most of them have fled to Western Ukraine while others have traveled further afield to other countries.

There is a way to deduct both medical and dental expenses but there are some restrictions. Answer 1 of 4. Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions including whatever is left of medicaldental expenses after subtracting the 75 will save tax.

That 20 is the portion you can. 502 Medical and Dental Expenses. Your dentist would not implant them unless they were a medicaldental necessity even if the procedure was elective.

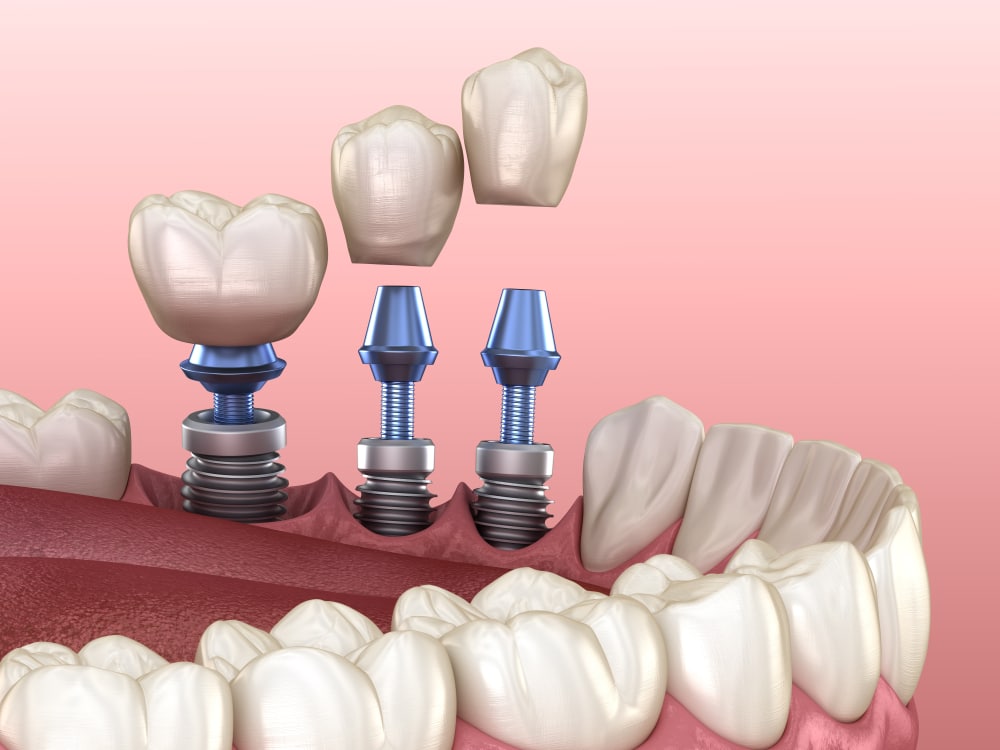

You can claim the portion of the procedure that you pay also known as the co-pay. So you should mention what country youre in when asking this type of question In the US you can look at the IRS site linked below. The dental implant abutment is usually attached to the implant body by the abutment fixation screw and.

The Medical Expense Tax Credit METC is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay. Provide Emergency Support for 144 Religious Sisters in Ukraine. Ad Search For Info About Are dental implants tax deductible.

For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible. You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20.

In order to deduct the cost of the dental implant you would need to do that in Schedule A on your taxes. Dental implants count because they affect the structure and function of your body. It also explains Medical care expenses include payments for the diagnosis cure mitigation.

Citizens or resident aliens for the entire tax year for which theyre inquiring. If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings Account. Yes Dental Implants are Tax Deducible.

Many have decided to stay on in. Since the war broke out on February 24 2022 more than 12 million Ukrainians have been forced to flee their homes. By being tax-deductible it means you can get a portion of the cost back in your next tax return.

Application of sealants and fluoride treatments to prevent tooth decay. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. Browse Get Results Instantly.

Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. Yes dental implants are an approved medical expense that can be deducted on your return. This includes fees paid to dentists for X-rays fillings braces extractions dentures etc.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. If any of your expenses were reimbursed by insurance your expenses must be reduced by the amount of the reimbursement. Dental office deductions extended under the American Taxpayer Relief Act of 2012 Use tax benefits to reduce your office construction costs.

The IRS states that the total paid for dental implants can be reported as a medical expenditure on Schedule A Itemized Deductions. Generally the Internal Revenue Code allows as a deduction the expenses paid during the tax year not reimbursed by insurance for medical care of the taxpayer his or her spouse or a dependent to the extent that such expenses exceed 10 of adjusted gross income. Although it does not help you to get rid of all the costs that you have to spend on the dental implant you will get some relaxation to pay off the full cost of a dental implant.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. Lets look at what can and cannot be claimed on your tax return as well as how to claim these expenses. Per the IRS Deductible medical expenses may include but arent limited to the following.

Yes Dental Implants are Tax Deducible. When you itemize the irs allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2020. Your dental implant expenses are tax-deductible in the United States per IRS guidelines clearly stating that payments made for artificial teeth qualify.

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says. You can include in medical expenses the amounts you pay for dental treatment. The second factor involves your adjusted gross income.

You can use it via Schedule A to cut off your tax amount on your dental implant grants. For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. Basically If you itemize your deductions for a taxable year on.

While not specifically non-deductable and pub 502 has a paragraph on artificial teeth stating they are deductable Iwould imagine you. You can claim eligible dental expenses paid in any 12-month. You can get all the details at the IRS website on Topic No.

Most non-cosmetic dental expenses are tax deductible. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. If one or two crowns are placed to rehabilitate your bite due to an accident illness or disease they.

However I can give you the easy version here. The dental implant body is surgically inserted in the jawbone in place of the tooths root. For 2017 and 2018 you may deduct only the amount of your total dentalmedical expenses that exceeds 75 of your adjusted gross income.

The tool is designed for taxpayers who were US. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. Tax laws vary by country as all laws do.

Are Dental Implants Tax Deductible. For future reference keep in mind that for 2019 dentalmedical expenses must exceed 10. If you hire an accountant to do your taxes just let him know about your implants and they will know what to do.

SearchStartNow Can Help You Find Multiples Results Within Seconds. Did you know your dental implants may be tax-deductible. If married the spouse must also have been a US.

Services of a dental hygienist or dentist for teeth cleaning. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Yes dental implants qualify as a tax-deductible medical expense under current Revenue.

Dental implants are considered a medical expenses. Other dental work not paid by your insurance plan.

/BestDentalInsuranceforImplants-5c56e663e267499a8011f1e26d260841.jpg)

Best Dental Insurance For Implants Of 2022

The Complete Guide To Getting Dental Implants In Thailand

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Dental Implant Cost Near Me Clear Choice Cost Maryland

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

3 Irs Dental Implant Discount Plans Tax Deductible Savings Dental Implants Irs Taxes Tax Deductions

Implants Dental Insurance Premium Benefits Alternatives

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

How Can United Medical Credit Help Me With Dental Implant Financing United Medical Credit

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Implant Cost Near Me Clear Choice Cost Maryland

Dental Implant Cost Near Me Clear Choice Cost Maryland

Dental Implant Cost Near Me Clear Choice Cost Maryland

Does Medicare Cover Dental Implants Clearmatch Medicare

Dental Implant Cost Dental Implants Start From 900

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants